Featured Articles: Good Writing From Around The Web

How to Get Ahead of 99% of People (Starting Today) [Video]

This is the best description of what it takes to be “successful” that I have ever heard. And, it makes it OK to not want it.

For everyone considering starting a business… it is the way to wealth, but it will consume you. Wise words of warning.

Expanding Awareness of the Science of Intellectual Humility

I’ve been harping on humility in my industry for years. How did I not know this was happening in my own backyard???

Ten Ways to Breathe Meaning into Existence

All of these, but especially #s 1, 6, 7, 9, & 10.

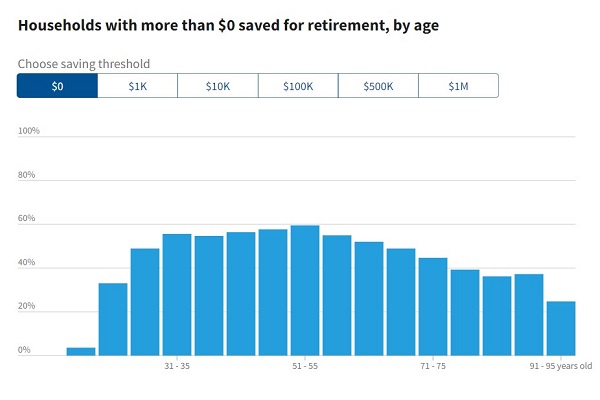

Half of American Households Have No Retirement Savings

We are simply not saving enough. Put your savings in perspective.

__________

If you’re a Millennial, Gen Z, or Gen Alpha, then you might be curious about Financial Independence. If you’re a Boomer or Gen X, you probably still refer to it as “Retirement.” In its simplest sense, both phrases refer to the time when you have enough passive income to pay your living expenses as they increase from year to year due to inflation for the remainder of your life.

Whatever you call it, if you desire a passive income that you cannot outlive, then there are three things you need. You must:

1. Know your independence number

2. Build a resilient “all-weather” portfolio – what we call a Mindful Portfolio

3. Embrace a management and withdrawal process – what we call Mindful Management

If you’re not clear about any of these items, I hope you will join us for our Financial Independence Bootcamp where we will answer each of these questions together. We host the Bootcamp every quarter and we limit the size of the Bootcamp because we want everyone who joins us to walk away with each of these questions answered.

Always reading, always learning, Jonathan hand-selects these articles for readers each week. To view Jonathan’s curated articles from previous weeks, CLICK HERE.