COVID-19 has changed the way in which we invest, spend and how we prioritize what we have, and what we need to live our best lives. Predicting how the stock market or any other investment is going to do is not a sure thing. Reflecting on where we’ve been, and where we are, can help us understand how to move forward.

This article is a transcription of a discussion between Jonathan DeYoe and Scott Jacobs, where they discuss the global markets and economies in light of COVID-19. DeYoe broke down his 2021 Half-Time Report into three parts: Where We’ve Been, Where We Are, and Where We May Be Headed. Read on for Mindful Money insights.

Skip to:

Where We’ve Been

- Bending the Curve 1:03

- COVID 19 Vaccine Incentives 2:02

- The Markets 2:32

- “Vaccine Day” Rally 3:58

- Robust Earnings Growth 5:43

- Fiscal Stimulus 7:38

- Investors Embraced Speculation 8:28

- Treasury Markets Reflected Uncertainty 10:52

- Home Sales Went Through The Roof 11:53

Where We Are

- The Economy is Growing 0:58

- Unemployment is Improving 2:09

- Unemployment Theories 2:28

- Spending Is Up. Saving Is Down. 4:12

- Inflation is Rising Faster Than Expected 6:48

Where We May Be Headed

- Economic Growth 2021 1:04

- Base Case: 6.6% 1:06

- Best Case: 7.4% 2:23

- Geopolitical risks 3:35

- Growth Can Be Affected by Debt 4:06

- Positives 7:15

- Data Privacy Protection 8:26

- Skill-Building Robots 9:05

- Rapid-Charging Electric Car Batteries 10:16

- Self-Healing Building Materials 11:07

- Questions On The Content Above 12:16

Where We’ve Been

Scott Jacobs: Let’s talk about the great opening. It’s been about 16, 17 months since this all started. We’re all glad we are here to talk about it, and obviously, vaccines have been a big piece of why this has all happened. A year or so ago, we didn’t know these were coming. We were hoping for them to come, and here they are.

Bending the Curve 1:03

Scott Jacobs: Back in January or February, there were about 250,000 cases at its peak of COVID in this country, which was pretty scary at the time. We’re now down to about 12,500 per day–which is a light-year difference–and there’s only one thing you could point to what’s causing that: the rollout of the vaccines.

I do want to point out, though, that we are a global economy, and although we’re doing really well here with vaccinations, you see that that’s not the case [everywhere]. Africa’s got a ton of work to do, the northern part of South America has a lot of work to do, parts of Europe still has work to do, and so, until that happens, commerce and tourism can’t really ramp up until this country–and the rest of the world–gets vaccinated a whole lot more. We’ve made a tremendous amount of progress throughout the country and the world.

COVID-19 Vaccine Incentives 2:02

Scott Jacobs: I don’t know if you’ve heard of some of this stuff. When I started hearing about it, I almost wasn’t believing it, but they’ve got all sorts of things going on to motivate people to get vaccinations. They’re giving out free doughnuts. They’re having all sorts of lottery drawings. They’re giving out Super Bowl tickets, Major League Baseball tickets, paid time, and more. We’re doing what we can to get there, and again, we’re making a ton of progress, but we still have quite a bit of work to do.

The Markets 2:32

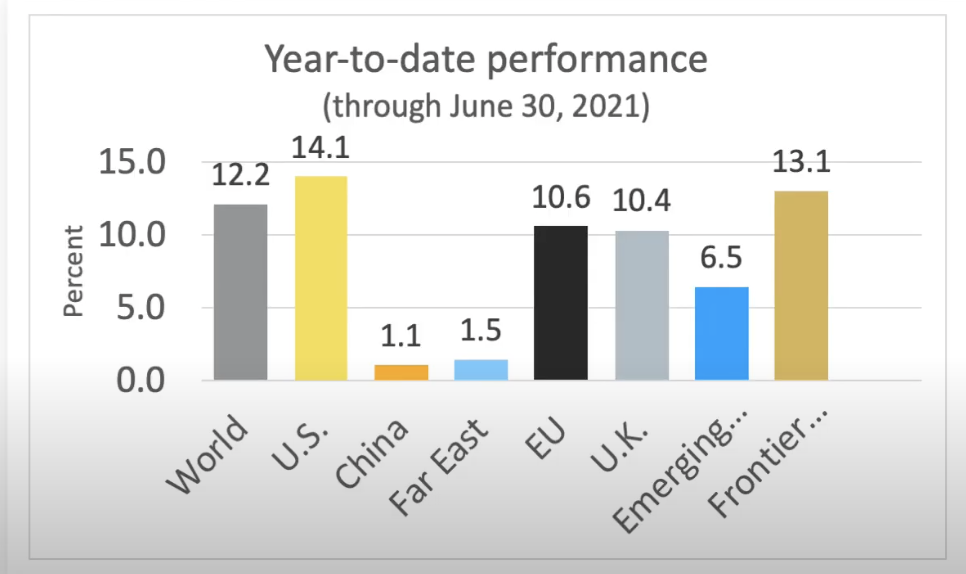

Scott Jacobs: Let’s talk about the markets and what’s going on. This is a very small case study in that it’s only year-to-date. Year-to-date is just January to the end of June, a very small picture of time relative to the long term, but we’re talking about where we’ve been, so let’s get a sense of what that looks like.

It’s obvious what’s happened globally, I mean, except for China in the far East as you notice down here at the bottom or in the middle here [in the chart], most of the globe. The world itself is 12.2%, the US is 14.1%, the frontier markets/emerging markets, the UK is showing tremendous amounts of rates of return in just a very short period of time, and so the global economy is working. The global economy is expanding, and people are becoming much more optimistic than they were just a year ago.

If they [the media] do not recognize that we’re in a ripping raging bull market, not just in stocks in the stock market, but art, cryptocurrency and memorabilia, autographs, and anything and everything, assets are inflating. Anyone who’s not seeing that, I don’t think they’re paying attention. The globe is working, and here the performance has been tremendous.

“Vaccine Day” Rally 3:58

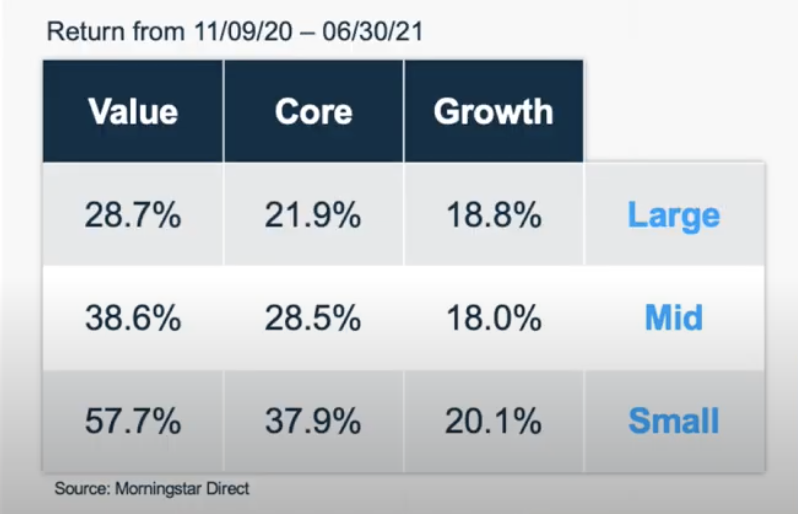

Scott Jacobs: If you recall, when the vaccine was actually announced and rolled out back in November, I guess around November 9th of 2020, when this all happened, and there was a massive shift in leadership. Most people on this call have had conversations with John or myself or any of the wealth advisors and planners, and we know that small outperforms large over long periods of time, we know value outperforms growth over long periods of time, but that hasn’t worked for many years. Now what’s happened since November, and this sort of vaccine day rally that we’ve seen, is that it’s actually going to start working out again.

You’ll notice here [in the chart] what’s happened in value vs. growth, tremendous outperformance. Look at small vs. large, the same thing. This is not a picture of time we want to extrapolate too much from, but clearly, in the last half a year, small cap and value stock have started to work and work in a meaningful way. Value stocks are stronger than growth these days, and that doesn’t mean it’s a permanent condition, but it’s just something we wanted to talk about as we talk about what’s going on.

This is a long quote from Aziza Kasumov from Financial Times, so let’s just speak to what they’re talking about here. About 40 companies–three or four dozen companies–announced they were suspending their dividend last year for many obvious reasons. The good news is, many of them–about a dozen–have now reinstated those dividends, and they’re going to fall into that kind of cyclical bucket of stocks. The largest beneficiaries of the economy, and the economic recovery that we’re experiencing now, are those kinds of companies. We think we’ll be seeing more and more of that coming online. The banks have announced a lot of big stuff as well in that regard.

Robust Earnings Growth 5:43

Scott Jacobs: Let’s dive in a little bit here with earnings and what’s happened here. Earnings were recovered in such a whopper of 52.9%, which is just a staggering number when the estimates initially were only about half that. Almost 90% of companies are coming in above earnings estimates. Again, getting back to what I said earlier, we’re in a roaring bull market. Some companies are struggling, but by large–on the margin–companies are doing exceptionally well across the board in many ways. We’re coming out of this with what will be titled “The Shortest Recession in the History of Recessions,” after what happened with COVID.

We had a horrific drop of 30-40% in about 28 days back in March of 2020, and for you to recover from that, you have to have a ferocious recovery. That’s exactly what we had. We didn’t anticipate it to be as fast as it did, and a lot of people hadn’t as well, but that’s why you stay fully invested, because you can’t predict that stuff.

Jonathan DeYoe: One quick thing to add here is that there’s a lot of conversation you’re going to hear right now, and we’re going to talk about it a little bit later, about valuations. One of the things that are so difficult about valuations and about looking at valuations is that when you look forward to the beginning of the year, you expect growth earnings to be about 23.7%. You build your portfolio based on the expectation of 23.7% of earnings growth, and it comes in at 53% of earnings growth. Suddenly, you are undervalued. What the market is doing is discounting this belief that our earnings are going to be higher than the analysts are expecting, so the market is saying, “you know what, the analysts are saying, yeah they’re very conservative.'”

Fiscal Stimulus 7:38

Scott Jacobs: We’ve had a tremendous amount of stimulus poured into the economy in the last year or so, 5.3 trillion to be exact, so far. The American jobs plan everyone’s heard of, the families plan as well. It’s hard for markets with this kind of flush-in inputs of capital into the system, and it’s hard for markets to suffer. It’s sort of putting in a net, the same thing happened in 2008, a backstop was put in, and although it was uncomfortable, it put in a floor. The markets–once they settled in–went back to all-time new highs, which is exactly what’s happened in the last 16 months, so huge stimulus, and probably more to come. This is a tremendous amount of capital that’s in the system now, that was not here just a year and a half ago, a lot of money floating around.

Investors Embraced Speculation 8:28

Scott Jacobs: There is a ton of speculation, and that’s what happens in bull markets. You’ve got the meme stock popularity–whether it’s GameStop or names like GameStop–it is hard to deny what’s happening. There are lots of questionable cryptocurrencies, maybe the bitcoins and the ethereum’s work, and it can become commonplace in the future, but there is–I think I saw a number like 9,000 now–out there. That’s how crazy it has gotten.

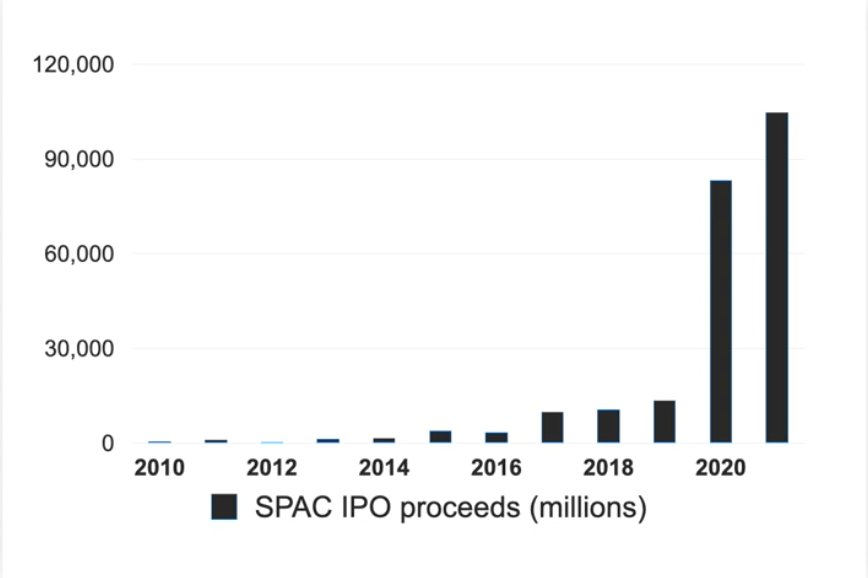

There’s just a tremendous amount of extreme share price valuations that are going on. Just take a look at what’s happened to the SPAC (Special Purpose Acquisition Company) market. They’re [in the chart] to the right. That market in terms of millions is what they’re using here. Look what was going on in 2010, 2011, 2012 and 2013. Look what’s happening now, so when you have cheap money, and it’s flooding the system, as it has for better or worse, it creates speculation, and there’s a lot of cheap money floating around. That is what’s going on here, so you have to be careful. It’s a lot of getting-rich-quick kind of thing going on, so you have to stick to your knitting and think of your plan.

Scott Jacobs: What these companies have done is that they’re blank check companies. They’re kind of like a shell company that a company that wants to go public comes and gets attached to them, and they go public not through the traditional means, and there has been a lot of that going on. It started out really exciting people–making a lot of money–and then it came to a screeching halt. People are losing a ton of money and it’s just that classic example of the next shiny thing. You’ve got to be really careful with this stuff. Virginia Galactic was, I think, brought to the public by a SPAC, and it flew to the moon–no pun intended–and it crashed to earth pretty quickly.

Jonathan DeYoe: We have a few written commentaries on the SPAC market on the blog, and we’re happy to forward them to somebody who wants them. I think the fundamental is that it’s not in favor of the investor to use these vehicles unless you’re a founder. If you start a SPAC, you’re going to make a ton of money regardless of whether the company is successful or not, so that’s enough reason for us to steer clear of these entirely. I feel the same way about most IPOs, but SPACs are definitely not in our favor.

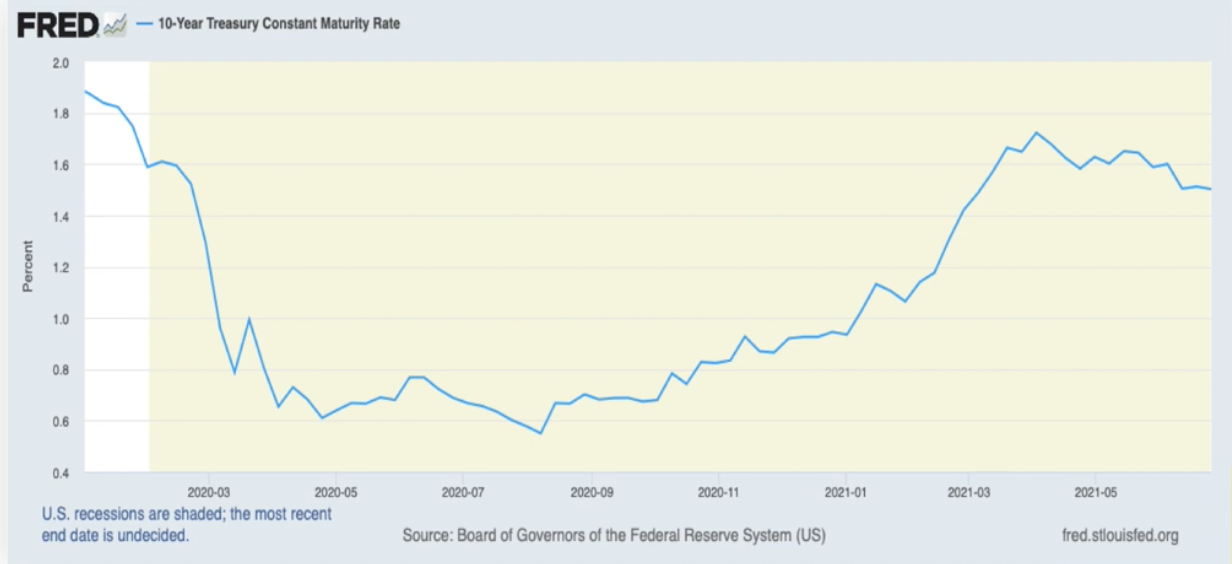

Treasury Markets Reflected Uncertainty 10:52

Scott Jacobs: Treasury yields in the treasury market have been an interesting place. You may recall in the middle of COVID–I can’t exactly tell from this chart–I believe we were down around 0.5, so 50 basis points. Meaning, if you hold a 10-year piece of paper issued by the US government, they would give you a whopping half a percent interest for 10 years to do that. That’s how low rates were. There’s a silver lining to all that. I’m sure a lot of folks on this call refinanced their mortgage, right, so when rates come down this low, there’s an equal and opposite reaction in that refi market. We’ve done this with many families, and it’s been a huge beneficiary to their plans, obviously. Unfortunately, checking saving CDs and bond rates and yields are opinions at best, but it’s been very volatile. The reason why it’s sort of rallied recently and come back down again is that there’s a lot of uncertainty in the bond market about what’s coming. There’s a lot of talk about what inflation means–is it transitory, is it going to stay for a while, and the treasury market usually gets a little choppy when that kind of thing happens. This shouldn’t be a big secret either to anyone on this call.

Home Sales Went Through The Roof 11:53

Scott Jacobs: This shouldn’t be a big secret to anyone on this call, and it’s not just a Bay Area thing. Home sales went through the roof all over the country. Areas like South Dakota, like Phoenix, places that normally don’t go wild have officially gone wild. Austin, Denver, it’s been pretty incredible what’s happening in real estate. Existing home sales went up by a huge number of almost 50 percent, a medium price for a home 350,000–I think that’s the highest level ever, or real close to ever–and the price increase is over 23%.

There’s still not enough home going around. We don’t believe this thing will end tomorrow. At some point, things have to slow down, but we don’t believe it’s pertaining to some big crash, even though everyone is predicting one. We are not in the prediction business. We are in the planning business. As you all know, that’s housing.

Jonathan DeYoe: There are two things, one, the difference between today and 2007-2008 is that there isn’t free money that there was in 2007 and 2008. That’s the first difference. The second difference is that there is an entire generation of home buyers that no one is built for, so there’s simply not enough housing out there. And, housing has to be built, the home builders are just on a tear right now, even though the price of lumber is so high, but home builders are on a tear because they have to build madly to keep up with and that’s actual demand. That’s why Scott said, we don’t think it’s a bubble or anything like that, but again, we can’t predict.

My parents asked me to say when I talked about this that Californians need to stop moving to South Dakota. People are buying in cash, putting cash down. They’re selling their house in California, and they’re buying a home for cash, and they’re driving up real estate prices, and they’re driving up the property taxes, and my parents are angry with us.

Where We Are

Jonathan DeYoe: All right, so we’re going to go through two more steps here where we are and then where we might be heading.

Scott mentioned this earlier. Inflation is increasing, economic and earnings growth are accelerating, and monetary and fiscal policy remains very supportive. That’s a rare combination, having all those things more together, and there’s something that they say all the time in like industry meetings, and that’s don’t fight the fed. The Fed has been very clear that we are going to be very supportive. The new administration has been very clear: we’re going to spend lots of money, and all of that ends up supporting equity markets, even if rates go up slightly, so that’s all positive.

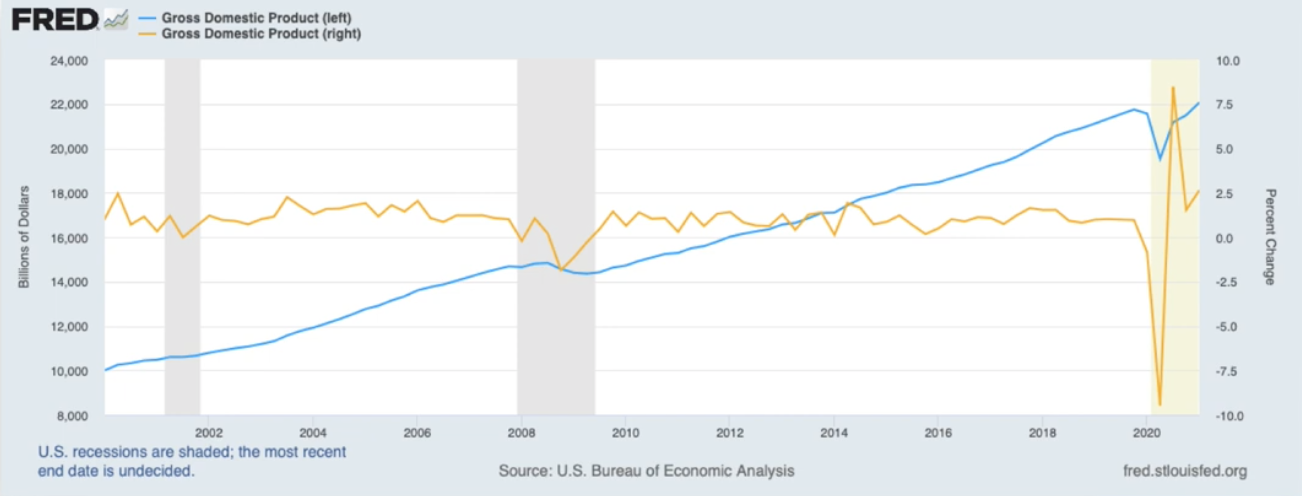

The Economy is Growing 0:58

Jonathan DeYoe: The reality is there are two lines here [in the chart]. The blue line is the size of the economy that is the trillions of dollars of GDP that the U.S. puts out, and the very far left of this chart is the year 2000, and it’s not a straight line, but it’s pretty darn close, with 2008 being a very minor blip. Once you look past it, [see chart] what’s happening over the COVID thing out ten years, it’s going to disappear over time, and the yellow line is the very extreme–the trailing 12 months–it’s the recent year-over-year rate of growth in the GDP.

The economy is growing for sure, and the print that we are going to get, I think it’s the 29th of this month, we’ll get GDP for the second quarter. That’s going to come in somewhere in sevenish, nineish. It’s going to be a record. It’s going to be a very big print. And there’s a reason to think that it slows from that number, but it doesn’t go to sub 2% anytime soon.

Unemployment is Improving 2:09

Jonathan DeYoe: At the same time, unemployment or employment is improving, and it has improved very quickly, and now it’s improving slowly. That isn’t necessarily just because there aren’t jobs, there are jobs, but there’s a lot of information out there about a lot of reasons why. I think in June there was a study done that said that there are still four million people that want to go back to work–we had a meeting with a client a couple of days ago who really wants to go back to work, got the job, went back to work, was terrified and had to quit working again.

Unemployment Theories 2:28

Jonathan DeYoe: There’s an emotional challenge to get back to work and to be with people. And, when things go on, there are going to be challenges. You know, there’s a Delta variant, a Lambda variant, and there will be issues. Not just real fears, there’s going to be also psychological things that come out of this. Some people said unemployment benefits were too generous, so we’ve got about 50 of the states that are reducing those. They’re not improving any faster, so that’s probably not the reason.

An interesting thing, for years, we’ve been trying to increase the lower wages, and what we’ve discovered is, when employers really need to hire somebody, and they raise their wages, they can find people to hire. That’s an interesting discovery that companies are discovering, right. A lot of parents can’t go to work if kids don’t go to school, and that’s still an issue in some places. Or, if you have to be a caregiver for somebody, you can’t go back to work. These are normal issues that have always existed. Many people–and we are experiencing some of this in the office–are reconsidering their careers. You know, do I want to do this? Do I want to do something else? And, if someone wants to do something else, now is a great time to do a career shift. A lot of folks are hiring, the opportunities exist, and so they are making those changes. There are some other things as well that are changing the unemployment story.

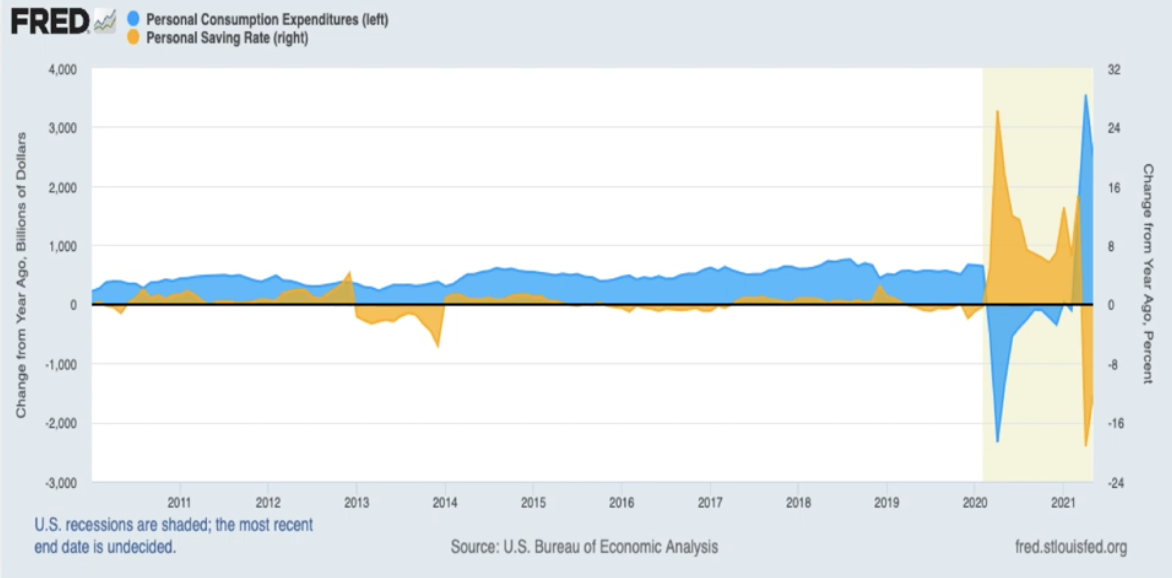

Spending Is Up. Saving Is Down. 4:12

Jonathan DeYoe: We have all this pent-up demand like what we see in this [chart] yellow/orange/yellow above the line here is this all the non-consumption. This is all the savings that we did during the pandemic, whereas we didn’t consume. These are the changes in consumption and the changes in the savings rates. The blue is the change in consumption, and the orange is the change in the savings rate [chart]. We’ve seen that we can spend again–we are spending, spending–and our consumption is going up, and our savings are going down. But, this is what we call revenge spending. We haven’t spend for so long, and now, we’re going to do the things we want to do. Scott was referring to earlier that we still can’t travel everywhere we want to travel. I have clients who love to travel that tell us they’re still not comfortable going to places they love to go to, so they’re not scheduling those things.

I know my wife and I look to doing some travel this summer, and we started a little bit too late, and by the time we got around to reserving space, there was no space to reserve. There were no cars available, the lodge was full, the cars were gone, and we just said, “you know, forget it, we’re going backpacking.” It’s interesting, there were lots of opportunities for backpacking, like the permits for backpacking in the Kings Canyon Wilderness, where there are many permits, so we got it. It’s incredible. That’s what we prefer to do anyways, get away from people. And then, at the same time, supply chains, right. All of these things, labor issues, commodity prices, you might have seen that lumber went up a thousand percent. The price of lumber went up a thousand percent–for anyone trying to rebuild something–and now it’s come way back off, so it’s already come back to earth a little bit, but the price of materials, you’ve probably heard about the chips in cars or computers or cellphones. I have a 16-year-old son, you know, he’s not a clothes horse, but occasionally, you got to buy a shirt for the kid, and we went online to try to buy shirts for the kid, and there weren’t any. You couldn’t get the eight-dollar shirt or the $12 shirt. You could get the $80 shirt that was available. You could find that, but there were no reasonably priced shirts anywhere, which is bizarre to me.

Inflation is Rising Faster Than Expected 6:48

Jonathan DeYoe: What this all leads to is it leads to this question, and this is really the big question. We have inflation. It’s being called transitory, but there is a problem with using the word transitory in thinking about inflation because inflation stacks. If we have 5% inflation now, that doesn’t go away unless we have deflation later. So, if we have 5% inflation, which becomes 2% next year, we’re building that 2% on 5% that’s permanent. So, transitory is the wrong word to use, unless you’re just talking about that number 5%. It is, I think, a very fair thing to say that the 5% we’re seeing will slowly decline to three and a half, and then to two and a half, and then to two, and that’s largely because there are four deflationary forces that are much bigger and much more powerful than the government spending eight trillion dollars. Those four forces are the availability and broad availability of information because of the internet–this is not even a new thing anymore. The fact that all this information is available out there in terms of pricing products drives prices down. If I can go online and look at copper or lumber or shirts for my son or shoes or jeans or solar panels and compare prices, that means prices have to go down. Everyone competes on price.

Demographics. People are–and this is largely a millennial thing–spending money differently. They’re more interested in doing good than they are in buying things. They’re more interested in experiences than in stuff, which means the demographics will drive prices down. Globalization, there is a question about how global we’re going to be. That’s one of the long-term issues we will have to face, but globalization is not going away. And, finally, technology. Technology is a deflationary force, and those four things are more powerful–I believe–than our enormous government spending programs. The government still has to spend wisely. Infrastructure makes sense. There are things that we should do, and I hope that we see that. If we don’t, that won’t kill us, but it’ll be much better if we see it because we’ll see growth return, and things will be better.

I think that transitory is the wrong word to describe inflation. I do think we’re just seeing a blip, and that blip will calm down in the future, so I’m not worried about long-term seven and a half percent 1970s inflation, not at all worried about that. That doesn’t mean the fear isn’t there. That doesn’t mean the headline risk doesn’t exist. There is this concern that if the Fed sees inflation and if–agitators, and there are out there–people are saying to the Fed, “you’re wrong, you’re wrong, you’re wrong, you’re wrong.” If the Fed changes course and decides, “you know what, maybe we should be careful, and we should raise rates’,” and they do that too early, that will reduce growth. If they taper their bond purchases, which honestly they should do. Right now, they’re spending $80 billion a month on mortgage securities to boost the housing market, really? The housing market doesn’t need boosting right now. That is as strong and healthy as possible. So, there is the fear that the Fed will raise rates is itself a market effect. If we are all afraid the Fed will raise rates, then we will all try to get ahead of that, and that has an effect on valuations, so we’re watching that very closely.

Where We May Be Headed

Scott Jacobs: I just wanted to speak to one thing. So, there’s this overlying comment that you hear all the time like interest rates going up is bad for the markets. I want to speak to a period of time that you could all relate to, and this was in 1994. Greenspan rose rates a half a dozen times in one year, and so, you might expect the next few years would be a really tough time for the markets, right. Interest rates go up, and markets don’t do well. What it did–if you recall–1994 was not a great year. What came after he raised rates six times in one year? 1995, 1996, 1997, 1998 and 1999, the tech bubble. So raising rates unto itself does not destroy markets; there’s no evidence supporting that. I wanted to speak to that because this huge fear of interest rates destroying the stock market is not supported in evidence.

Economic Growth 2021 1:04

Jonathan outlines two case scenarios on how much the economy will grow. The first one is the “base case,” which means that it’s what it’s expected to be. The second one is the “best case,” which means that the economic growth we see could be, potentially, much higher than it was initially thought.

Base Case: 6.6% 1:06

Jonathan DeYoe: Looking forward, this is for the year, ending in this quarter. This is the conference board. This survey is about lots of information economists have given, and they give us an idea about what growth is going to be. There’s a base case that we’re expecting 6.5-6.6% growth. So they have a base case of 6.6, and then they say, “You know what, the worst-case scenario the vaccine mutates, we have a new wave of the shutdown, we have a new wave of virus, we have a new wave of issues of response. Vaccines are ineffective. We have the Fed tightens too soon, we have the improvement in unemployment declines. The consumption that we know we all want to continue, and we know that there are things that we want to buy that we’re not buying yet because we can’t, things aren’t available.”

I’ve got a buddy who ordered a pickup. He ordered a pickup three months ago, and it keeps getting pushed out. One more month, one more month, because there are no chips for the pickup he’s buying. We’ll spend less. Or we might see a stock market correction that’ll make us all feel less wealthy. So these are the worst-case.

Best Case: 7.4% 2:23

On the flip side of that, there’s this best case. What if COVID cases continue to fall. What if this most recent Delta variant uptick stimulates those states where you see that uptick to vaccinate more quickly. What if we have less social distancing or if the infrastructure plan passes or the next thing passes. You know, all kinds of things could happen that could increase it above 6.6%, and there are all big things. So, if we see 7.4%, and just remembering that that’s for the year, we could see up to 9% in the quarter, when they report the second quarter on the 29th of July, we could see a 9% number. But, even looking back for the year–the 12 months prior–you could see an average of 7.4. That’s a big growth number, and that’s not the end of it. Next year we probably see 3.5-4%, and the year after that we probably see 2-3%, and so. That GDP also stacks, so 7% and 4.5% on top of that, and 3% on top of that. Pretty soon, our $29-10 trillion economy is a $34-35 trillion economy.

Geopolitical risks 3:35

Jonathan DeYoe: There are serious issues. We have a continuing issue with China, a growing issue with China. We have this new thing–not new, but it’s growing in prevalence–with cyber attacks. We have the variants, we have vaccine questions, and these are definitely risks. But, there are also some really big positives.

Growth Can Be Affected by Debt 4:06

Jonathan DeYoe: This is another big risk. So there’s some research done by the department of the treasury and St. Louis Fed, that said that right about 85% of debt to GDP and the debt starts affecting the GDP itself. We are at 127% of GDP; that’s our debt level. But, as GDP grows–which we’re seeing a massive number of GDP growth coming at the end of the second quarter–we anticipate that number to be large at the end of this year, and large next year, and large in 2023.

So, suddenly that debt–yes we have borrowed a lot, and that number is very large–but if we grow the GDP, we can grow our way out. We grow our way out of this debt bubble, and that’s, I think, the goal. The goal is to invest in infrastructure. The goal is to invest in productive things, and if we invest in those productive things, we grow our way out.

John Madden: That’s something that we’ve been talking about for several years now. There are many people out there that think that we can handle the debt, and we can handle it even better as we continue to grow. I mean, it doesn’t seem to make sense, but I think it’s been borne out over the past several years.

Jonathan DeYoe: Yeah, so the debt service is very low even though the debt number is very high. So there’s a window of time that we can grow the economy, so the percentage of debt to GDP is lower, or we can slowly reduce that debt level. Think about it, some of this debt is just money that the treasury purchased and the fed purchased from the treasury, right. So, some of this debt is debt that was money we were printing to send money to people, so it’s money that we’re just printing in the system, but we have to retain that as debt.

We’re doing some of the things for the bond purchases, the $120 billion a month of bond purchases, the Fed’s balance sheet. As that declines, the debt declines. As the Fed’s balance sheet matures, then the debt declines. Those two things go hand in hand. That happens just naturally over time. And, if we can grow a little bit if some of those maturities come, and so the debt shrinks–and we do that while debt service is low–we have the capacity to spend, we have space.

It’s ridiculous not to when–and you’ve probably read Krugman (Twitter @paulkrugman), you’ve probably read a bunch of people suggesting this–we have an opportunity here while the price of debt is so low, and we all did this with our homes. We have an opportunity right now to do this as a country while the price is so low. And we have a lot of stuff we could do, and we’re trying to take advantage of that, getting a little pushback, as we all know.

Positives 7:15

Jonathan DeYoe: I want to paint a little picture with some other positive things. There are risks out there, but there are also things we never hear about and if you think about it. This is Malcolm Gladwell, one of my favorite authors–I love reading his stories. He and Michael Lewis are the best storytellers out there. I mean, if you think about this, if every car on the road is autonomous, and they all play well together. They all stop. They’re all careful. They’re all patient. They’re not going to run people over. They’re all working together. They communicate with each other. It means pedestrians, and cyclists and little kids playing soccer in the streets are safer. It means the human access around us is better, so there’s a human benefit. At the same time–I got to check my notes to make sure I quote the right sources here–Bloomberg reports that this thing you see here [urban airports fro drones and flying taxis] is live, or will be live, in the port in Coventry in the UK, is going to have this air taxi next year. And then, in 2023, we’re going to start seeing these in the US. They are being built, urban airports for cargo delivery and urban taxis for faster transportation.

Data Privacy Protection 8:26

Jonathan DeYoe: At the same time, you know that we all know that when you receive an email, and it has an attachment or a link that you don’t know, you don’t click the link, right. But did you know that there are spy pixels in emails as well? What a spy pixel does, is it allows the email sender to track where you go from there. See what you do with the email. See how far down the email you read. See if you click on links inside the email, and there are these tracking pixels. Now, there are services, and there are subscriptions you can buy that tell you when you’re about to open an email that has a tracking pixel. That’s a positive. This idea of data privacy and our protection of ourselves is getting better, and companies are behind these kinds of things.

Skill-Building Robots 9:05

Jonathan DeYoe: At the same time, there is this Time magazine, and they’re reporting that robots are being built to encourage kids to read, to draw, to write notes to their aunts and uncles, encourage them to interact with the adults in their lives. A robot will sit next to you, and you’ve spent 45 minutes on your device. Maybe you want to go say hi to your mom, like that kind of thing. It’s to help kids develop social skills. To help kids develop writing skills. TO help kids.

How long is it before we have robots that help employees develop soft skills? I have been working for 25 years in homeless services in the city of Berkeley, and one of the big challenges is a lot of soft skills. How do you get somebody living on the street to get housing? To get regular checkups? To get a job? And part of that is a lot of the soft skills. So there are things out there being built by companies to do this kind of stuff.

Rapid-Charging Electric Car Batteries 10:16

Jonathan DeYoe: One of the big challenges we have on going to an entire electric economy is charging stations. There’s an Israeli company building this charging that will recharge your electric battery on your electric car in five minutes, faster than filling your car with gas.

Imagine my wife and I have one diesel vehicle and one electric vehicle, so we use the electric car for everything we do around town. Every time we get into it to go a distance, we argue. She says, “I don’t want to wait to charge the car,” and I say, “Well, what does it matter? It’s 45 minutes. We get to stop and have a snack. We wait for the car to charge and we get back on the road.” And sometimes I win, sometimes she wins. Imagine that that argument doesn’t exist. Now there’s no argument not to have an electric vehicle. Huge positive, the company’s doing that as well.

Self-Healing Building Materials 11:07

Jonathan DeYoe: This is, perhaps, the most interesting thing to me. I find these buildings that take from the air to heal the cracks that show up in the paint. Buildings that absorb toxins from the air in the paint or the drywall or in the actual infrastructure of the building. There are materials that companies that are working on these materials that clean the air, that scrubs the air, that heal themselves–very interesting stuff.

Now, none of these are mainstream yet. None of these are going to be huge anytime soon. But, if all you do is listen to the news or the nightly news, you don’t see any of this kind of stuff. You have to search to find the nuggets of really interesting positive things that are out there, which are great.

Questions On The Content Above 12:16

Jonathan DeYoe: Before we go into these last four things, are there any questions about anything we’ve just gone over?

Scott Jacobs: One question just came in about climate change and thoughts around that influencing the economy.

Jonathan DeYoe: There’s always someone. Who asks that question? I’m kidding, don’t give me a name.

Will climate change affect the economy? Yes. Will it affect an entire index? No. What it will do is it will say oil companies that don’t reinvest in solar or other energy sources will fail. Companies competing in an industry that spends and invests in plants and equipment that rely upon oil and that kind of energy gets more and more expensive because tax credits are added to tax costs. After all, it costs money to pollute because they will fail and suffer relative to their competitors, who are investing in electric vehicles and who are spending more upfront.

For buildings with an architectural level of clean building–the name is escaping me right now–if you’re really high-end, and you’re spending the money on the water capture, the waste capture, the clean energy on the refuse management better. If you’re the recycling systems that are internal to the building. If you spend that money upfront, it costs more to build the building, but it reduces the bill’s long-term cost.

So, people who invest in what we call “socially responsible” will eventually be called smart. People that companies that invest in these kinds of things will be more successful long term. It’s sort of the Jurassic method of companies failing because they don’t keep up with technology and aren’t competitive because of these kinds of things. And, the way we invest–just to touch on the way we invest in that kind of thing–is that we own everything, and we tilt towards value, small and profitability. And for folks that we work with that have socially responsible portfolios, they own everything. They eliminate some things and tilt towards being more socially responsible, which means we favor values-driven or return-driven things, but we own everything because this is a long-term process. I hope that that makes sense.

Any other questions?

Scott Jacobs: Yeah, another question came in, and then it was sort of repeated, which, I think, is an interesting question, “What do you make of the huge drop in the stock market yesterday?” And then, a follow-up from someone else was, “Yes, what about the stock market drop yesterday, although seemingly recovered today?”

Jonathan DeYoe: All right, we’re going to swing for the fences on this one. Not a thing. I don’t even think about it. I start thinking about making changes at about a 20% decline. I don’t believe that anyone can predict anything in the short term. I don’t think that anyone can explain why something happens in the short term. I think we’ve seen enough short-term crazy that doesn’t matter. One way to think about this is that a normal peak to trough decline is 15%; that’s a normal annual peak to trough decline. Now, what is 15% of 35,000?

Scott Jacobs: Over 5,000 points.

Jonathan DeYoe: Yeah. So that’s the Dow dropping 5,000 points. That would be normal. It would not be strange in any way, and it would be an average year. So, you should expect a 5,000 point Dow drop once a year, and you should treat it like, “Okay, I breathe in, I breathe out. That’s the tides, it’s not a thing to be worried about” or even think about “2% declines tend not to bother me.” And, to praise our client base, nobody called.

I did see, you know, I’m on social media. I saw a lot of advisors say, “ask the question, what do you do when your client calls and asks the question about a 2% decline?” I have to giggle. I have to say you know, you train them differently. You should talk about what normal volatility looks like, and that’s what we try to do, is talk about what normal volatility looks like.

Jonathan DeYoe: Okay, so just a couple of things. This is looking forward to what to think about what we just went through. We basically sandwiched five years of technological advancement, eight weeks, two month period of time in early 2020. There are a lot of companies that are catching up with that. There’s a lot of companies that didn’t move that quickly. We didn’t change everything that quickly, but we changed many things, and now, we’re trying to think through other things technologically. Every company is in the same boat. There are a lot of changes coming. This is positive in some ways, scary in some ways, negative in some ways. But because we own everything because of how we invest, we’re not worried about how this affects individual companies.

It’s just interesting how it’s going to shake out. And this should be, if you think back a little bit, a year ago we were worried about the collapse in growth, and now everyone’s worried about too much growth. And, if you fast forward to when growth starts slowing down again, I promise you the headline is going to be, “growth is too low.” Whatever is happening is somehow tilted to be a bad thing because bad news is good copy.

This is just something I tend to agree with. Over the next 12 months, stocks are going to be better than bonds. I think they’re going to be better than real estate, better than most assets, but they’re not going to be as good as they have been in the last 12 months. I mean, we’ve had a lot of client reviews in the previous few weeks, and we’re showing 12 month returns in the 30-40% range. That’s a moment in time comparing a very, very crappy March of last year, April, May of last year to a wonderful 12-month period, so don’t expect that again. It’s going to be less. It’s still going to be better, and, going forward, it’s still the best place. The equity market is still the best place to protect yourself from inflation, to participate in the upside. Again, your equities are an investment in productivity. They are an investment in innovation. They are an investment in the things that pay us long-term dividends as investors and as a culture. It’s very important to keep those in our portfolios.

I have to put Mohamed El-Erian (Twitter @elerianm) in here. He’s a brilliant guy, and every day he sees evidence of inflation not being transitory. And, he has concerns that the Fed is falling behind, and they may have to play catch up. And the Fed is notoriously bad at taking the punch bowl away when they’re supposed to. I think that Mohamed El-Erian and–there’s one other guy–that these are the two major agitators. I think they’re not giving the power of technology, information flow, demographics, those things we talked about earlier. I do think we grow our way out of this. Although I don’t like the word transitory, I do think it calms down from here.

Thank you very much.

Scott Jacobs: Bye. Thank you.

John Maden: Thank you, everyone.

*This transcript was edited for clarity.

Wrapping Up

Want to learn more about global markets and the economy in light of COVID-19? Watch the videos or learn more about how to improve your relationship with money here.