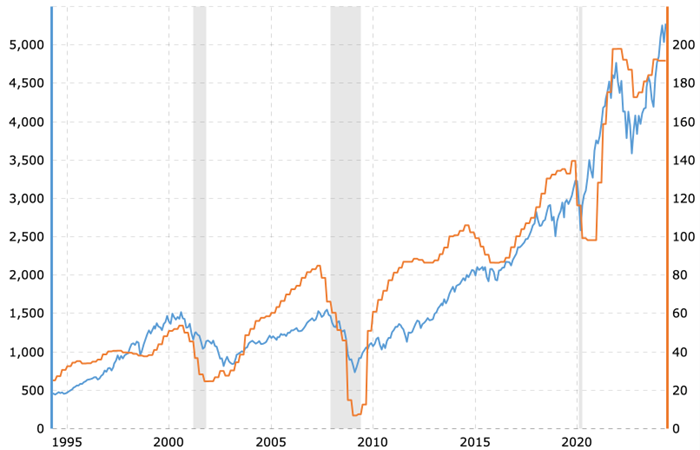

I talk a lot about the idea that stock prices follow earnings. This is what that looks like over 30 years:

At the same time, whenever the stock market is bouncing around near all-time highs (as it is today), I start to get questions about the market getting “too high.”

So… are today’s stock prices too high?

No!

The absolute height of the S&P 500 market price is often a focus for investors and media alike, but the market price in isolation does not provide a complete picture of the market’s health or any investment’s potential. What truly matters is the underlying earnings of the companies that comprise the index, relative to the price that market participants are willing to pay for those earnings (the P/E ratio).

When you invest in a company, the price is what you pay. What you receive is your per-share claim on current assets and ALL future earnings of that company (or index).

Earnings are the life blood of any company, reflecting its profitability and potential for growth. As the earnings of the companies in the S&P 500 continue to rise, it indicates that these companies are generating more profit, expanding their operations, and effectively managing their resources.

Higher earnings support higher stock prices, as investors are (and should be) willing to pay more for shares of more profitable and growing companies.

The price-to-earnings ratio, or P/E ratio, provides a way to evaluate whether the market price is reasonable relative to the earnings. A high P/E ratio may suggest that the market price is inflated compared to the earnings, indicating potential overvaluation. Conversely, a low P/E ratio might signal undervaluation.

Investors seek a balanced P/E ratio, reflecting a fair price for the earnings generated. This ratio helps ensure that investments are based on solid financial performance rather than speculative price movements.

Notice that the market price (chart above) moves upward and to the right, while the P/E ratio (chart below) doesn’t have a clear slope upwards. It can be volatile around a mid-point, but at the moment, we are pretty much in the middle of the long-term range… and earnings are increasing.

So long as earnings keep increasing (and most analysts believe they will), prices can keep going upwards.

A high S&P 500 market price is not inherently problematic if it’s supported by strong and growing earnings with a reasonable P/E ratio. This balance suggests a sustainable increase driven by real economic value rather than speculative bubbles. Investors should therefore focus more on earnings growth and valuation metrics than on the nominal price level of the S&P 500 to make informed investment decisions.

I entered the financial advisory business in 1996 as a broker for Dean Witter – when the S&P 500 was roughly 1500 and its P/E ratio was roughly 20 (on the way to 46 in the dot.com bubble). Since then, the S&P 500 price has just more than tripled, while the P/E ratio has increased roughly 30% (to 26).

The market is A LOT higher than it was, but that’s because earnings are a LOT higher than they were.

And the price that market participants are willing to pay is only slightly higher. And, in some respects… maybe the price we’re willing to pay SHOULD be higher.

Here’s Savita Subramanian, BofA US equity strategist talking about some of the changes in markets that would justify higher P/E ratios:

“I think the one bear case that I hear a lot that I want to try to debunk is just the idea that the market is too expensive. Folks will take today’s S&P and compare it to 10 years ago, 20 years ago, 30 years ago, and 40 years ago. I don’t think that makes sense because the market today is such a different animal… The S&P 500 [today] is half as levered, is higher quality and has lower earnings volatility than prior decades. The index gradually shifted from 70% asset-intensive manufacturing, financials and real estate companies in 1980 to 50% asset-light tech and healthcare.”

I conclude that there is no reason to be overly afraid of the prices that today’s market participants are willing to pay for such well-run, profitable, resilient, and innovative businesses.

As always, when your emergency fund is full and you have extra money… put it to work in your appropriately asset-allocated and broadly-diversified portfolio.

Right now… today.