It is obvious that it depends on the depth of a particular bear market. It’s slightly less obvious that it also depends a great deal on how long you have been invested.

If you have recently begun investing –OR– if you have recently changed your investing philosophy and a bear market arrives, it is very easy to become scared out of your process.

Because…

… if you have been enjoying average to good returns for a few years and then the bear market arrives, it can dig into your principal. Your “long term average” can go from high positive, to low positive, to negative, very quickly.

In fact, the sooner the bear market hits you after you invest initially, the more damage it feels like it does.

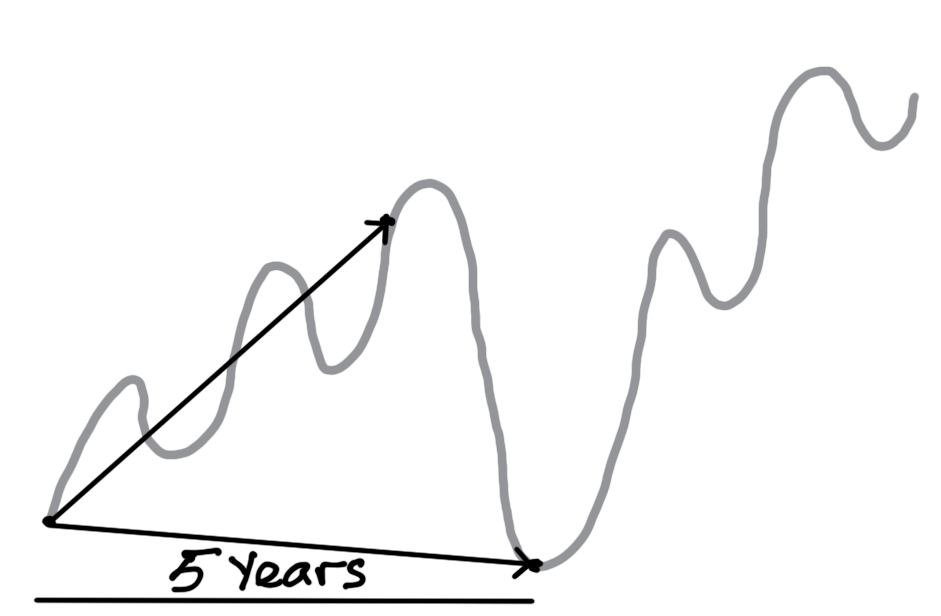

If you invested $10,000 5 years before the pandemic hit in March of 2020 and your particular portfolio had enjoyed an 8% average return up to that point in time, the pandemic’s 34% decline would have wiped away ALL of your gains and then some as your portfolio declined to $9,698 and your long-term average return plummeted to an average -.51% / year.

FYI – this is just math, there is no guarantee that you can achieve an 8% average return for any length of time and there is no way to predict when a bear market is coming or how it will effect any specific portfolio when it does. Same goes for all the numbers in this article.

You won’t have to search for negative bias-confirming headlines, nervous peers actively selling, or hyperbolic social-media wondering who’s to blame. This will all be delivered in a deluge.

This tests an investor’s resilience. The evidence that normal short-term volatility causes many investors to lose faith in their long-term portfolios is everywhere.

We always talk about focusing on the long-term. But you have to get to long-term to enjoy long-term. This means holding on to your portfolio through the normal, albeit painful short-term cycles.

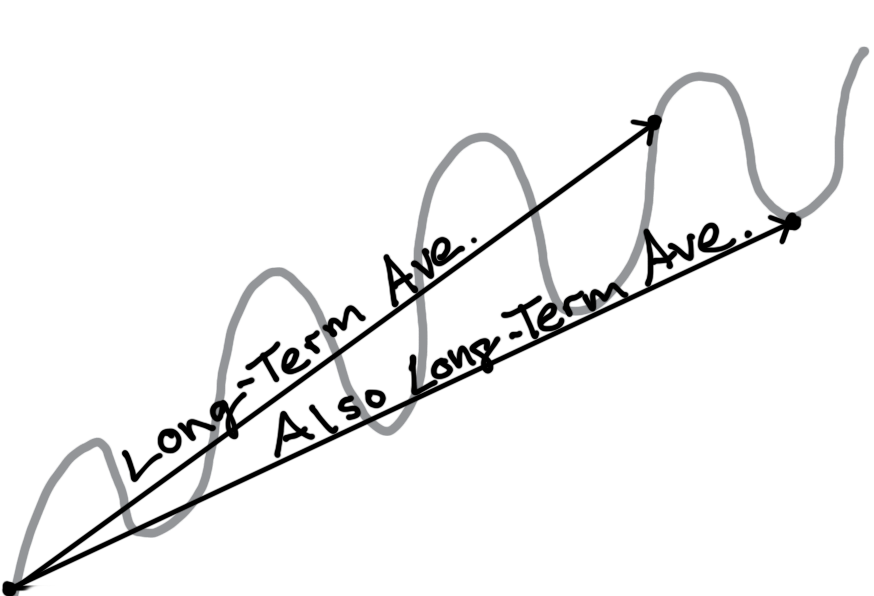

The longer you are invested, the lower the effect a bear market has on your average long-term return.

What if you had started investing 10 years before the pandemic (instead of 5) and had enjoyed the same 8% average return going into the pandemic’s 34% decline? You portfolio would have peaked at $21,589 and then declined to $14,249. Your long-term average at the bottom (this time for just over 10 years) would be 3.5%(ish) – not great, but positive.

If you had started investing 20 years before the pandemic and had enjoyed the same 8% average return going into the pandemic’s 34% decline, then your portfolio would have peaked at $46,610 and then declined to $30,762. Your long-term average at the bottom (this time for just over 20 years) would be 5.8%(ish) – not great, but better.

Not to pile on too heavily, but if you had started investing 30 years before the pandemic (way back in 1991) and had enjoyed the same 8% average return going into the pandemic’s 34% decline, then your portfolio would have peaked at $100,627 and declined to $66,414. Your long-term average at the bottom(now for just over 30 years) would be 6.5%(ish) – even better.

If you did it for 50 years, your average at the bottom after the decline would be 7.1%. And at 100 years (I know, who has the time), your long-term average would have only fallen from 8% to 7.55% after the very same 34% decline.

The longer you hold your portfolio, the less any dip affects your long-term average.

Another way to see the long-term diminishing effects of a bear market is to compare the angles between the lines of the following “invested 5 years before pandemic” and “invested 30 years before pandemic” graphs.

Note: For the 5 years from April 2016 to March of 2020 the annualized total return of the S&P 500 with dividends reinvested was a little over 8.5%. Data is from Robert Schiller’s Yale database.

Note: For the 30 years from April 1991 to March of 2020 the annualized total return on the S&P 500 with dividends reinvested was a little over 9%.

The more years you have of stacking up those average returns, the less the bear market effects your long-term average return numbers.

We have had a nice reprieve this week, but the volatility is not over. We broke a downtrend, but there are 2 large rate hikes in front of us and many headlines to go.

The benefits of staying allocated, diversified, and disciplined for the long-term will be important to remember as we continue to go through volatility in the coming weeks and months.