This blog is the fourth of a 10-part series which covers everything you need to know to get started on your path to financial freedom:

1. The First Step in Any Financial Plan is NOT What You Think. We Start by Knowing What is Worth Seeking.

2. Developing Your Vision of a Perfect Life

3. Adopt a Savings Habit

4. Emergency Fund Basics

5. Eliminate High-Interest Debt

6. Saving and Investing for Retirement

7. Paying Down Low-Interest Debt and Building Taxable Savings

8. Simple, Basic, Mindful Investing

9. The Final Step – Portfolio Optimizers

10. The 10 Core Beliefs of Mindful Investors

As we all know, life comes with a fair amount of challenges. Your car breaks down. A tree falls on your house. You lose your job. The proverbial s#!t happens. But none of it has to get in your way –

not when you have an emergency fund.

Once you’ve started the habit of saving, the first place to put that money is into an emergency fund. Nothing can derail your financial plan more quickly than an unexpected emergency you’re not prepared to handle.

An emergency fund helps you fix the immediate problem and stay on course toward your financial goals. Further, it provides invaluable peace of mind. In retirement, your emergency fund allows you to afford your living expenses during periods of volatility in your investment portfolio without damaging the long-term, income-producing strength of the portfolio.

At its core, financial planning is the art of insuring against what can go wrong in order to earn the luxury of investing for what can go right. An emergency fund is your first line of defense.

What Is an Emergency Fund?

Essentially, an emergency fund is a significant amount of fully-liquid cash in a savings account. After all, cash is the only financial instrument that is completely dependable in an “emergency.” It is readily available, easily accessible, and the value isn’t going to decrease like an investment account that will rise and fall with the market.

You can’t know when the next temporary setback will occur, so you must plan for it to happen at any time. The worst possible outcome of building an emergency fund is that you never use it, which is actually the best scenario.

How Much Should You Save In an Emergency Fund?

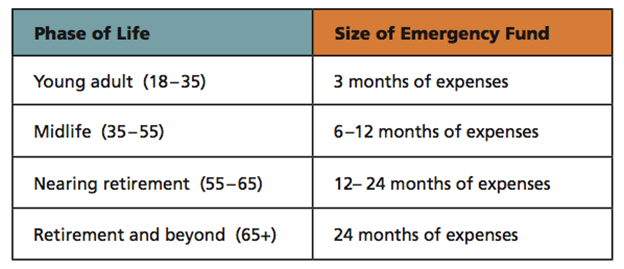

The amount you should put aside in an emergency fund depends on personal factors, such as your age, income, lifestyle and dependents.

Generally, the older you are and the more complex your life is, the larger your emergency fund should be. As a young adult, you typically have lower expenses, greater variety of job (income) prospects, and fewer financial responsibilities or dependents. But, as you age, life grows more complex – spouse, home, kids, etc. Your expenses go up, more people rely on you, and there’s a lot more at risk if there is an emergency or you lose an income.

To give you a better picture, let me break down the recommended emergency fund amounts by life stage.

Young Adult

For individuals, couples or families just starting out, three months’ worth of expenses is the minimum to save. Bear in mind, that needs to include all expenses. Not just regular monthly bills like rent or mortgage, electricity, cable and phone service, but also out-of-pocket expenses like food, gas and entertainment.

As a young adult, it can be a challenge to save. That’s okay. No one, regardless of age and income, should expect to put away a full emergency fund in one fell swoop. Instead, grow your emergency fund slowly and deliberately. If you can only afford to add $20 per paycheck each month, then do that. At the very least, save a certain minimum amount to develop the habit.

Middle Years

During the midpoint of your working life, from about 35 to 55 years old, your lifestyle costs are usually at their highest. You may be raising a family and/or investing in future obligations like retirement or college tuition. Amidst all these financial needs remains the possibility of various emergencies or even job loss. Since you don’t want to touch your investment portfolio, you need a bigger safety net of about six to 12 months’ worth of expenses.

Near Retirement

During the final years of your working life, you should strive to have 12 to 24 months’ worth of expenses in your emergency fund. The reason being that the years immediately before retirement pose the greatest risk to your long-term financial health. Consider at this point much of your future income will come from your investment portfolio, which is subject to unpredictable market swings.

There’s always a chance a market downturn happens right as you’re about to start withdrawing income from your portfolio – remember that these cannot be predicted or controlled. Without an emergency fund, a major market decline could make you delay retirement. Worse yet, if you lose your job or experience an unexpected emergency, you might need to tap your portfolio while it’s down. Under those conditions, your portfolio may never recover, forcing you to lower your lifestyle. A healthy emergency fund buys you valuable time for your investment portfolio to rebound.

In Retirement

Once you retire, you should maintain two years of emergency savings. Remember, retirement can last upward of 20 to 30 years. An emergency fund will come in handy when the markets inevitably tumble 5-6 times during that long span of retirement.

Calculating Your Emergency Fund Amount

After you’ve determined how many months your emergency fund should cover, you need to come up with a hard figure. You can do that in three simple steps:

- Consult your budget and add up your monthly expenses. Don’t forget to include those infrequent expenses like property taxes and insurance.

- Multiply that monthly expense total by the number of months of emergency expenses you plan to save.

- Decide how much per month you will devote to building up your emergency fund. Start saving that money in a separate bank account now.

When To Use Your Emergency Fund

When is it okay to dip into your emergency fund? Well, only you can answer that. Ultimately, an emergency must be a true emergency for you. It is best to limit the use of the emergency fund to large unexpected expenses – such as storm damage to your house – and avoid using it for a desire like a vacation you can’t really afford or a down payment on a car (these can be set up as separate savings goals).

Perhaps of greatest need for most people is during a period of unemployment. A three-month cash reserve can save you a lot of grief, until you get back on your feet. If you can tighten your belt a little, you may be able to make your emergency fund last a little longer.

Another legitimate emergency is to pay for medical expenses, which account for most bankruptcies in America. Even with good insurance, deductibles can run in the thousands of dollars and a family out-of-pocket maximum might be over $10,000. We dipped into our emergency fund in 2022 specifically for this reason. I spent 4 days in the hospital in late November and our emergency fund covered my out-of-pocket maximum expenses.

Ultimately, an emergency fund gives you breathing room in tight spots. Better to have an emergency fund and not need it than need an emergency fund and not have it. An emergency fund won’t stop bad things from from happening, but it will equip you to deal with what comes your way.

The simple preparation of an emergency fund gives you back control of your life. Having cash on hand when you need it prevents small setbacks from becoming large disasters.