3.9%

The latest employment numbers were worse than expected… but that didn’t stop the aggregate unemployment numbers from falling below 4% for the first time since the beginning the pandemic. And the year just past, we saw almost 6.5 million jobs created – the most jobs ever created in a single year.

From the BLS website:

“The basic concepts involved in identifying the employed and unemployed are quite simple:

- People with jobs are employed.

- People who are jobless, looking for a job, and available for work are unemployed.

- The labor force is made up of the employed and the unemployed.

- People who are neither employed nor unemployed are not in the labor force.”

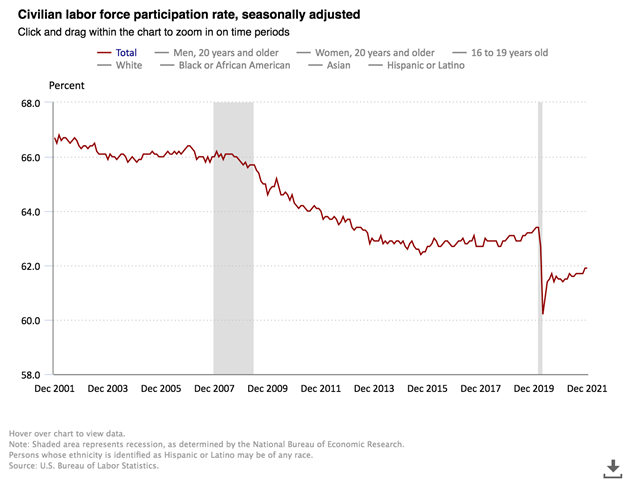

That last bit is important because the “labor force participation rate” has been shrinking for many years – across many presidents.

And, it took a big hit from which it has not recovered during the pandemic. Some have retired, which is fine. But, some are too afraid to work given the risk of COVID infection –

and still others have simply given up the search for employment.

We hit 3.5% unemployment – a 50-year low – before COVID19 hit. 3.9% is not far off. But this 3.9 comes with a labor-force-participation-rate-asterisk.

Inflation

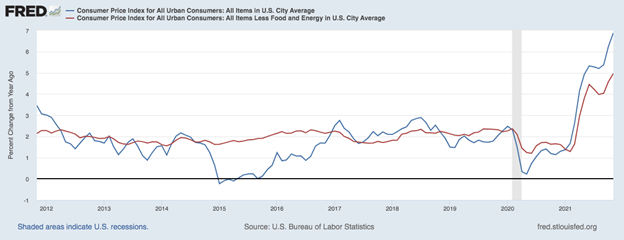

When one product gets more expensive, it’s a problem for that product’s suppliers as consumers choose other similar products as replacements.

When a few related products get more expensive, we know that there are issues up and down the supply chain for that group of products. Both consumers and governments start to ask questions.

When the number of products seeing price increases continues to climb and spread across industries, and the climb lasts longer and goes further than the FED had expected, the FED changes their stance from being dovish and stimulating the economy, to being more hawkish –

and beginning to take away the punch bowl.

In the past few months, we have seen market expectations shift rapidly from asking whether tapering may begin in 2022, to expecting both FED tapering AND the beginning of the balance-sheet run-off. At the same time, we have seen expectations shift from no rate increases, to 2, then 3, and now even 4 potential increases in 2022.

No one can predict what markets will do. And, there is some evidence that innovative companies (read: growth) reap outsized rewards from a very stimulative environment. And, as rates rise, companies that rely on an ultra-low cost of capital struggle, while those that can manage expenses as well as grow revenues begin to become better portfolio holdings.

This is the classic growth-to-value hand-off.

*Do not use this thinking to time the market. Own it all, and be aware of how different parts of your portfolio may react to the changing environment. Those parts aren’t broken. This doesn’t mean you change what you’re doing… we never know how long a change may last, how deeply the changes may be reflected in our portfolios, or when the environment may change again.

As goal-focused, planning-driven investors, we keep it simple. We allocate appropriately, we diversify broadly, and we rebalance through all the hand-offs that come.